"Interesting Times"

Interesting Times

by - Thomas Twombly

artist - Daisy Lopez

We are now living, as the fabled Chinese curse prescribes, “in interesting times.”

That is not a comforting opening line, I know. But under the circumstances, if I were to attempt to be comforting, it might sound hollow to you. For the record, it would certainly seem so to me. There is nothing comforting about any of what we’re experiencing in financial markets, geopolitics, international trade, or our current sense of overall stability. Everything is in flux, and it would be surprising if you weren’t at least a little unsettled.

This is not a time for comfort. This is a time for sterner stuff, and a time for being very clear about what you can control, and what you can’t. It’s a time to dig deep, and to muster every ounce of strength you have inside you to maintain your patience, your discipline, and your long-term, hard-nosed faith in the future, despite everything provoking you to do otherwise. We’re here to help, so please call if you’d like to talk.

Each of those three long-term investment principles is being severely tested right now – in you, in us, and in every single person around the globe who is paying attention to the uncertainty we are all being forced to endure. The tension and stress are palpable.

But it’s worth remembering that these feelings are not entirely unfamiliar - to you or to me. And as difficult as they may seem to bear right now, it’s worth revisiting other times when we’ve had similar feelings, so we can learn from our own experiences.

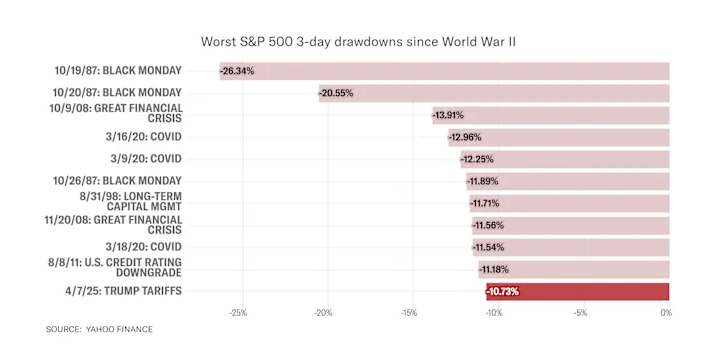

I captured the following graphic from Yahoo Finance on Tuesday, April 8th, as equity markets plunged after so-called “Liberation Day.” It illustrates the worst 3-day drawdowns in the S&P 500 since World War II, and it offers some perspective into the volatility we have recently experienced. Not that it’s comforting, but other periods have clearly been far worse.

I laughed wryly when I first looked closely, because every single one was a time I experienced during my career. I remember all of them. All were miserable. None of them would I wish on an enemy, let alone a friend or client. But they all provided important lessons concerning why those three principles I mentioned above, combined with the three practices of asset allocation, diversification, and rebalancing, have worked so well for us and for our clients in the long run.

Except for the three examples from the “Black Monday” period in 1987, years before this firm was founded, and the one example from the collapse of Long-Term Capital Management in 1998, before I started writing these reports, every other example was addressed in one of the previous 93 Quarterly Reports I have written to date.

I offer some brief but timeless observations from each of those reports, and links below, so you can read my musings in their entirety if you wish. Hopefully, you might glean some benefit from how “sterner stuff” has proven valuable in past crises. You’ll also find all our Quarterly Reports under the “Resources” tab of our website at www.lsggroup.com

The third quarter of 2008: The Great Financial Crisis

“So while the ties of the world beyond our control sometimes appear to be unraveling at warp speed, we observe that those of trusted individual relationships are knitting much closer together, and at a similar pace. We suspect we are not alone in this experience. In spite of the current turmoil, this is a reason to be positive in the long run.”

The third quarter of 2011: U.S. Credit Rating Downgrade

“Train yourself to slow down, and to recognize that that very same volatility is ultimately your friend - if you treat it that way. The massive swings that result from the frenetic, knee-jerk behavior of others can often present the calm-minded and patient with significant opportunities. It’s not easy, but it is simple.”

The first quarter of 2020: COVID

“I hope to dispel a misperception we’ve heard in some of those conversations. Namely, that we must be flooded with such a high volume of worried calls from other people that we don’t have the time to have an in-depth conversation with you. I assure you this is not the case. We are available, and we want to speak to every single client and friend who would like an ear or a sounding board.”

Thank you again for your confidence and trust.

Thomas G. Twombly

President